How much can you normally borrow for a mortgage

And there are lots of. Mortgage lenders typically banks and finance companies sell individual mortgage loans to another entity that bundles those loans into a security that pays an interest rate similar to the mortgage rate being paid by the homeowners.

What S The Monthly Repayment On A 100 000 Mortgage Beehive Money

Heres what you need to know about the CARES Act end date and more.

. Home-buying process steps to buying a new house or flat in England Wales and Northern Ireland. You can gauge how much of a mortgage loan you may qualify for based on your income with our Mortgage Required Income Calculator. 1 How much income you need to qualify for the mortgage or 2 How much you can borrow or 3 what your total monthly payment will be for the loan.

Youd normally need at least a. Before you can obtain a mortgage you must undergo a qualification process. A mortgage must go toward the purchase of the listed property and an auto loan must go toward the specified car but a line of credit can be used at the discretion of the borrower.

Note that your mortgage lender cant tell you who you can or cannot sell to but they are allowed to ask for a buyers pre-approval or proof of funds. Balloon Loan Calculator. Set a sale price.

How to buy and sell a home through estate agents. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. As the exact method of how this 10 is calculated varies by lender.

These bonds are created from the mortgage payments of residential homeowners. However as a drawback expect it to come with a much higher interest rate. How much can I borrow for a buy-to-let mortgage.

If you cant. Mortgage forbearance is a hot topic with the presence of coronavirus. However fixed-rate mortgages typically have an annual overpayment limit of 10 of your TOTAL outstanding mortgage balance.

Forms are also available at certain pharmacies or alternatively call 0300 330 1341. Lenders also tend to have an upper age limit normally you cant be older. Home equity loan.

If you miss your mortgage payments your guarantor has to cover them. These allow you to borrow ebooks audiobooks or magazines for free if youre a library member. If you do borrow more you could end up with two loans.

This is the portion of the home you actually ownLenders typically require that you have between 15 percent and 20 percent equity. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. Details of the income tax youve paid.

A title search can run from 150 to 500. Use our mortgage calculator to see how much mortgage you can get in the UK how much mortgage you can afford and how much deposit you need for a mortgage. An MMM-Recommended Bonus as of August 2021.

The amount you can borrow with a buy-to-let mortgage depends on how much youre expecting to earn in rental income. How big your deposit is how much you earn your credit score and your current debts. A home equity loan HEL allows you to borrow against the equity youve built up in your home.

How much you can borrow with a mortgage is determined by several things. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and student. News and opinion from The Times The Sunday Times.

This provides you a ballpark estimate of how much you can borrow from a lender. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. To give you an idea of how much fees can add up before closing the appraisal on a single-family home can range from 313 to 420 according to HomeAdvisor.

The more common of the two is the 801010 mortgage arrangement in which the home buyer is granted an 80 percent loan-to-value LTV on the primary mortgage and 10 percent LTV on the second mortgage with a 10 percent down payment. At PropertyGuru you can find thousands of properties for sale and rent with detailed information about each property including maps and photos. It also gives you an overall picture of whether you satisfy minimum requirements for a mortgage.

See the average mortgage loan to income LTI ratio. This mortgage qualifying calculator takes all the key information for a mortgage and lets you determine any of three things. FutureLearn and OpenLearn have free online courses you could try.

Your equity is calculated by assessing your homes value and subtracting. Typically a lender will want to see a rental income thats 20-30 more than your mortgage. There are up to 200000 so-called mortgage prisoners trapped in their current mortgage deal.

How much can you afford to borrow for a mortgage. You can pay by card or to spread the cost direct debit. NHS season tickets cost comparison.

Saving a bigger deposit. This mortgage finances the entire propertys cost which makes an appealing option. If you cant visit your local library some libraries have apps you can use online.

If you become eligible for free prescriptions after buying a certificate you can reclaim the proportional cost for that time. Calculate your monthly mortgage repayments to see what you could afford to borrow when moving house remortgaging or buying your first home. How much can I borrow.

Both options require you to have a certain amount of home equity. If you cant save enough some mortgages let you apply with a guarantor instead of a deposit. The piggyback second mortgage can also be financed through an 8020 loan structure.

Including when you remortgage to a new lender as the new provider pays off the debt on the old deal you normally pay an exit fee which is usually a few hundred pounds. Federal Student Aid. You can use this tool to find your local library service in England and Wales.

15 years vs 30 years. The mortgage pre-qualifying process is an informal assessment of your ability to repay a loan. You will normally have to provide two- or three-years worth of tax returns and business accounts.

If youre on your lenders standard variable rate or youre on a tracker mortgage there is normally no limit on how much you can overpay your mortgage by. With help from your real estate agent set a reasonable sale price for your home.

How Many Times Your Salary Can You Borrow For A Mortgage

Borrow Up To 7 Times Income With A Second Mortgage Niche Mortgage Broker

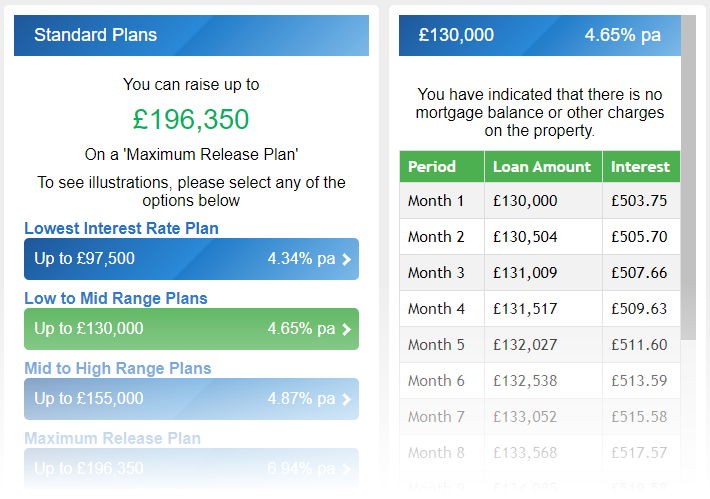

Equity Release Calculator No Personal Details Required

How Much Can I Borrow For My Mortgage Times Money Mentor

What Are Mortgage Affordability Checks Compare My Move

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

The Cost Of Buying Your First Home Moneysupermarket

Standard Mortgage Simple Fast Mortgage

Compare Our Best Buy To Let Mortgages Money Co Uk

The Cost Of Buying Your First Home Moneysupermarket

The Cost Of Buying Your First Home Moneysupermarket

Money Tribune Income Tax Deduction For Home Loan Under Section 24 80c And 80ee Buying A Home Is A Costing Affair For Any Investing Income Tax Tax Deductions

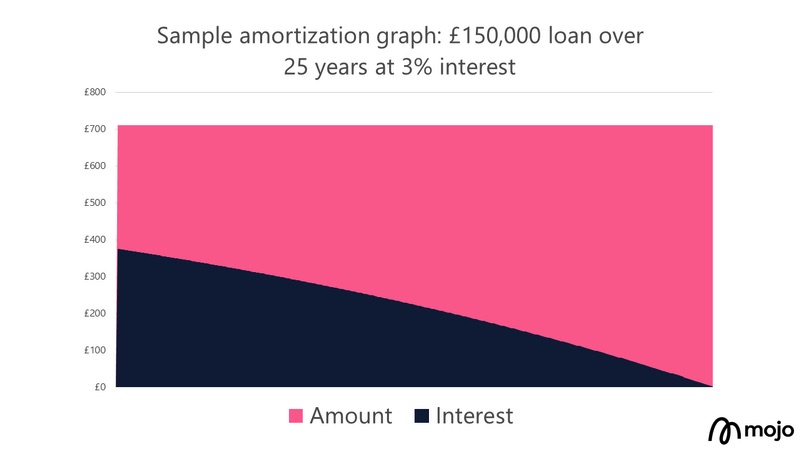

Mortgage Repayments Calculator Times Money Mentor

Further Advance Mortgage Additional Borrowing On Your Mortgage

/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

Residential Mortgages

How To Get A Mortgage If You Re Over 40 Uk Moneyman